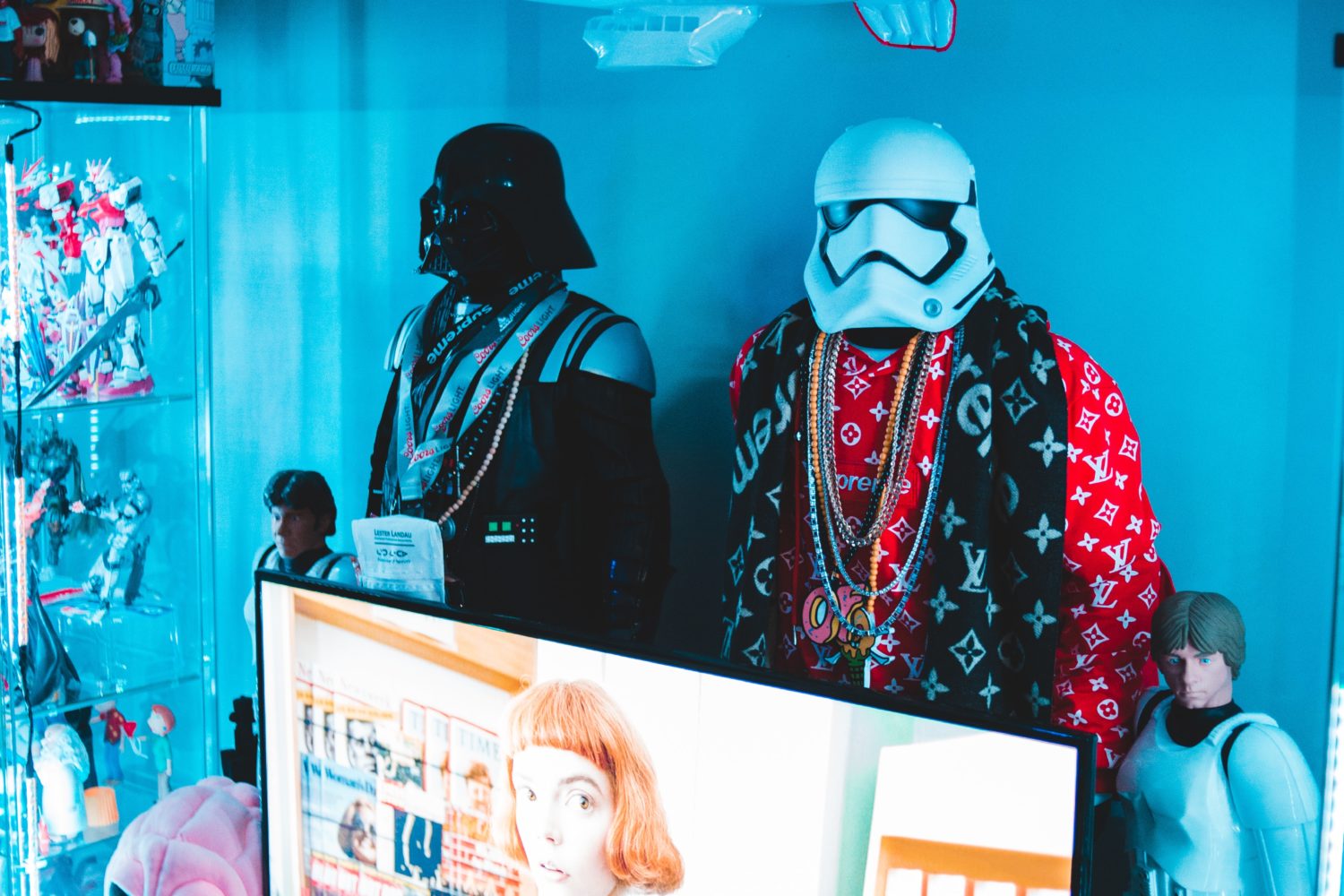

Title: Collectibles Online Store Business Loans and Financing: Empowering Growth and Success

Introduction:

In recent years, the popularity of online collectibles stores has skyrocketed, driven by passionate collectors and a thriving online marketplace. While the potential for success is undeniable, the growth of these businesses requires diligent planning, strategic investments, and adequate financing. This blog post will delve into the realm of collectibles online store business loans and financing, shedding light on how they can help propel your business forward, how they work, their costs, and more.

1. How Collectibles Online Store Business Loans Can Fuel Business Growth:

Obtaining a business loan can play a pivotal role in taking your online collectibles store to new heights. Here’s how:

1.1. Purchasing Inventory: Collectibles often command substantial upfront costs, and securing a business loan allows you to invest in a wide range of sought-after items, expanding your offerings and attracting more customers.

1.2. Expanding Marketing Efforts: Effective marketing strategies are crucial for any online business, especially in the competitive collectibles market. With additional financing, you can allocate funds towards digital advertising, optimization, social media campaigns, influencer collaborations, and other initiatives to boost brand awareness and drive traffic to your store.

1.3. Enhancing Website Functionality: Investing in user-friendly website interfaces, responsive design, enhanced purchase systems, and seamless checkout processes can significantly elevate customer satisfaction and encourage repeat business. Collectibles online store business loans can aid in implementing these vital improvements.

1.4. Hiring and Training Staff: Scaling your business often necessitates the addition of capable employees. With a business loan, you can hire experts in the field, such as knowledgeable collectors, marketing professionals, or customer support agents, to provide exceptional service and assistance, ensuring customer satisfaction and loyalty.

2. How Collectibles Online Store Business Loans Work:

Collectibles online store business loans are typically offered by banks, credit unions, and online lenders. The application process involves the following steps:

2.1. Eligibility Assessment: Lenders assess several factors, including your credit history, business performance, and revenue projections, to determine if you meet their criteria.

2.2. Loan Amount and Terms: Upon approval, the lender will specify the loan amount and repayment terms, which may vary based on your creditworthiness, collateral, and the lender’s policies.

2.3. Documentation: You will need to submit relevant documents, such as financial statements, tax returns, and business plans, to support your loan application.

2.4. Approval and Funding: Once your application is approved, funds are typically disbursed directly to your business account. The repayment schedule will be determined by your agreement with the lender.

3. Example of Collectibles Online Store Business Financing:

Let’s consider an example to understand how collectibles online store business financing can drive growth:

Suppose you operate an online store specializing in vintage comic books. To expand your inventory and capitalize on market demand, you secure a $50,000 business loan from a lender at a competitive interest rate of 8%. With this funding, you purchase a variety of desirable comic books and hire an experienced collector to curate collections for your store.

As a result, your store gains greater recognition within the collector community, attracting a larger customer base and generating increased revenue. This enables you to repay the loan while maintaining a healthy profit margin for future expansion.

4. Qualifications and Costs of Collectibles Online Store Business Loans:

While eligibility criteria may vary among lenders, the following factors are generally considered:

4.1. Credit History: A strong credit score enhances your chances of approval and favorable loan terms. However, alternative lenders may cater to businesses with less-than-optimal credit scores.

4.2. Annual Revenue: Lenders often assess your business’s financial stability by examining your revenue trends and projections.

4.3. Time in Business: Established businesses with a proven track record are more likely to secure larger loan amounts and better terms.

The cost of a collectibles online store business loan depends on various factors, including the amount borrowed, loan term, interest rate, and repayment structure. Generally, interest rates can range from 4% to 15% or more, with additional fees like closing costs and origination fees.

5. Pros and Cons of Collectibles Online Store Business Loans:

To make an informed decision, it’s essential to weigh the advantages and disadvantages:

5.1. Pros:

– Facilitates business expansion and growth

– Provides immediate access to capital

– Helps build creditworthiness

– Offers flexibility in how funds are utilized

5.2. Cons:

– Interest rates and fees can add to the overall cost

– Requires responsible financial management and repayment

– Collateral may be required for larger loan amounts

Conclusion:

Collectibles online store business loans and financing present a valuable opportunity for growth and prosperity in a thriving market. By leveraging these financial tools, you can bring your collectibles business to new heights, expand inventory, cultivate customer loyalty, and establish your online presence. However, it’s important to meticulously evaluate loan options, costs, and repayment plans to ensure that the benefits outweigh the associated risks.

Remember, success in the collectibles industry requires a combination of passion, market knowledge, strategic planning, and adequate funding. With the right approach and necessary capital in hand, your online collectibles store can flourish and leave a lasting mark on the passionate collector community.

Photos provided by Pexels

Photo by Erik Mclean: https://www.pexels.com/photo/a-television-and-collectibles-on-display-5795434/